wv estate tax return

Address to which he would return if released from the care facility. West Virginia State Income Taxes for Tax Year 2021 January 1 - Dec.

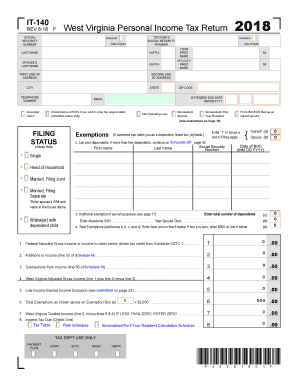

West Virginia Tax Forms And Instructions For 2021 Form It 140

Open the email you received with the documents that need signing.

. The West Virginia tax filing and tax payment deadline is April 18 2022. Address to which he would return if released from the care facility. West Virginia State Tax Department will begin accepting individual 2021 tax returns on this date.

This final estate tax return is necessary only when an estate is large enough-at least 114 million in assets as of 2019-to require payment of estate taxes related to the. The proper forms and instructions will be sent to the ExecutorAdministrator after the appraisement has been filed. Any estate required to file a Federal Estate Tax Return Form 706 will be required to file a West Virginia Estate Tax Return.

Article 10 Chapter 11 of the West Virginia Code. See reviews photos directions phone numbers and more for Wv State Tax Return locations in Tornado WV. Due date to file 2021 tax return request an extension and pay tax owed.

The exemption equivalents are. Does West Virginia have an Inheritance Tax or an Estate Tax. Only estates subject to the tax imposed by West Virginia Code 11-11-3 will be issued a release of lien pursuant to West Virginia Code 11-11-17.

Log in to your account. The exemption equivalents are. Tax Return will also be required to file a West Virginia Estate Tax Return.

West Virginia begins 2022 tax season. No separate reconciliation is required IT-101Q Employers Quarterly Return of Income Tax Withheld - Form and Instructions IT-101V Employers West Virginia Income Tax Withheld. The taxable year of the estate or trust for West Virginia income tax purposes is the same as the one used for federal tax purposes.

In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a us estate tax return form 706. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate Tax Return Form 706.

Commerce over the territory of the state and therefore are exempt from ad valorem property tax and do not have a tax situs in West Virginia for purposes of ad valorem taxation. The IT-101A is now a combined form. I The Internal revenue Service requires the filing of a Federal Estate Tax return Form 706 for the estate of every citizen of the united States whose gross estate at the time of death was larger than the amount of the federal exemption equivalent.

The Department of Revenue administers and enforces West Virginia revenue laws including the regulation of insurance banking and gaming industries as well as. However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million. In addition if you are inheriting property from another state that.

Prior to 2005 West Virginia like many other states did impose a state estate tax. Due date to file 2021 tax returns with approved extension. Find IRS or Federal Tax Return deadline details.

The effect was to divert some of the federal estate tax to the. Payment of Additional Estate Taxes in WV. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a WV state return.

For tax year 2021 the due date for an annual Estate or Trust West Virginia Fiduciary Income Tax return is April 18 2022. IT-1001-A Employers Withholding Tax Tables IT-101A Employers Annual Return of Income Tax Withheld. I The Internal evenue Service requires the filing of a r Federal Estate Tax return Form 706 for the estate of every citizen of the united States whose gross estate at the time of death was larger than the amount of the federal exemption equivalent.

Go to the Chrome Web Store and add the signNow extension to your browser. The tax was sometimes called a pick-up tax or sponge tax because it was equal to part of the total federal estate tax. West Virginia collects neither an estate tax nor an inheritance tax.

A real estate deputy assessor will be. The proper forms and instructions will be sent to the fiduciary once the appraisement has been received by the State Tax Department. Nor is there a West Virginia estate tax which again would be charged to the estate of the deceased.

The depreciation schedule can be found on Form 4562 of your tax return. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Moundsville WV. The median property tax in west virginia is 46400 per year for a home worth the median value of 9450000.

For decedents dying July 13 2001 and after a release or certificate of non-liability from the West Virginia State Tax Department. Tax Information and Assistance. Any estate required to file a federal estate tax return form 706 will be required to file a west virginia estate tax return.

Below are five simple steps to get your wv state tax department fiduciary estate tax return forms 2008 eSigned without leaving your Gmail account.

Wv State Tax Forms Fill Out And Sign Printable Pdf Template Signnow

Form It 141 Download Printable Pdf Or Fill Online West Virginia Fiduciary Income Tax Return For Resident And Non Resident Estates And Trusts 2017 Templateroller

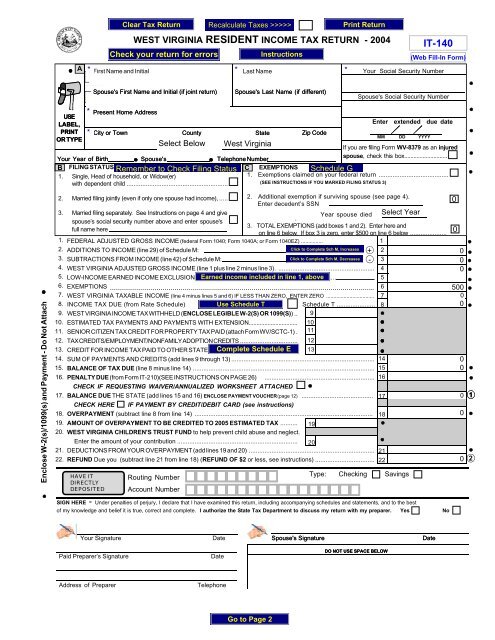

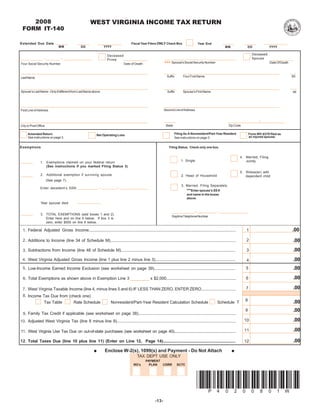

Form Wv It 140 State Of West Virginia

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

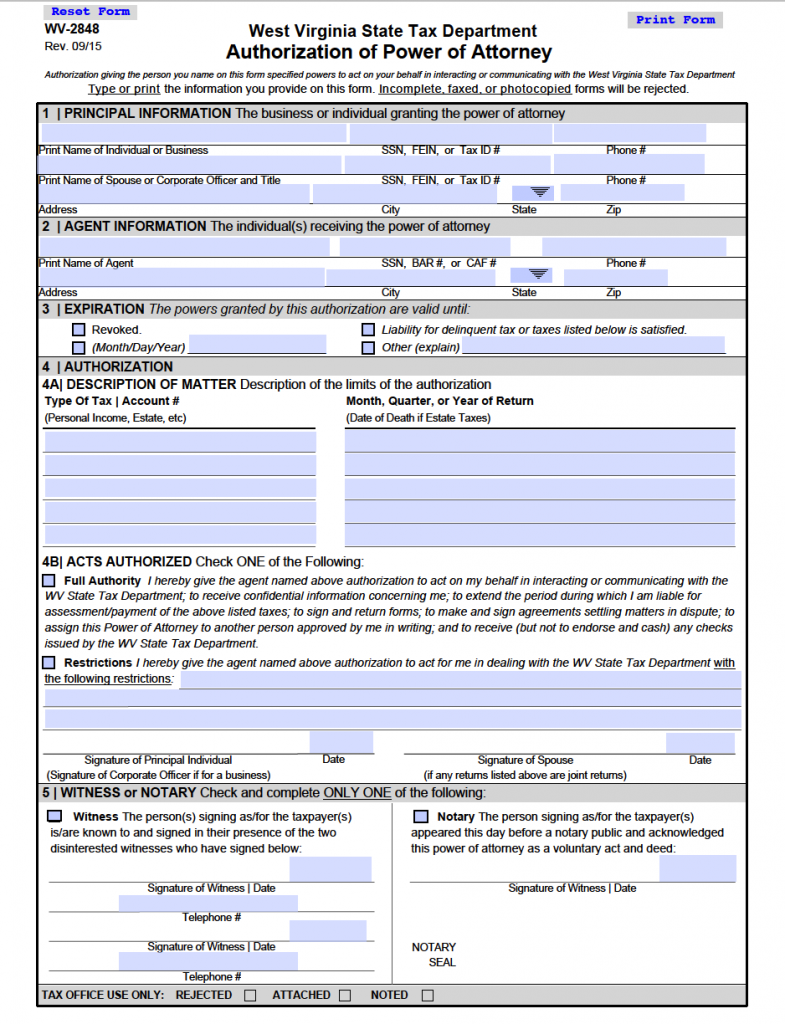

Free Tax Power Of Attorney West Virginia Form Adobe Pdf

It 1040 X Amended Individual Income Tax Return

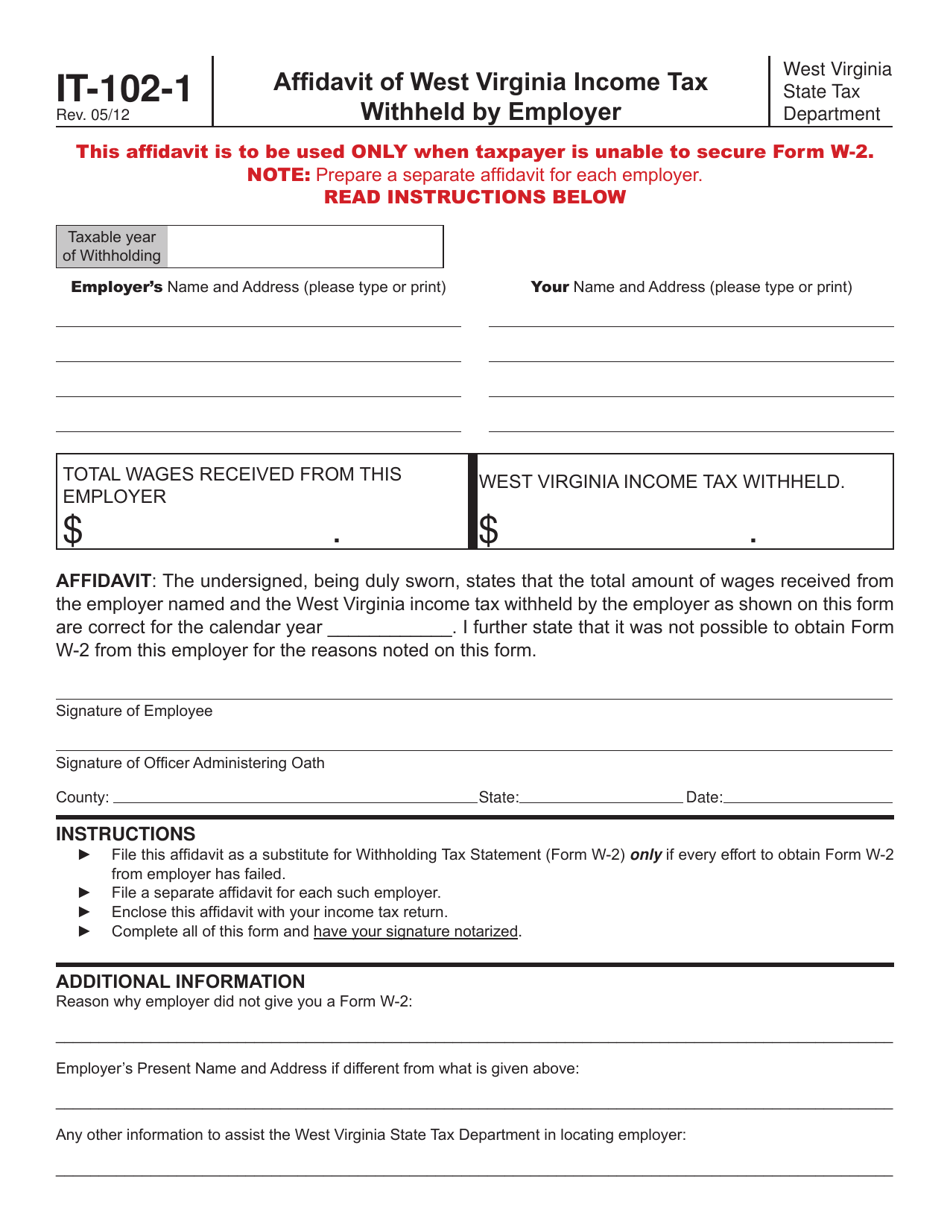

Form It 102 1 Download Printable Pdf Or Fill Online Affidavit Of West Virginia Income Tax Withheld By Employer West Virginia Templateroller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

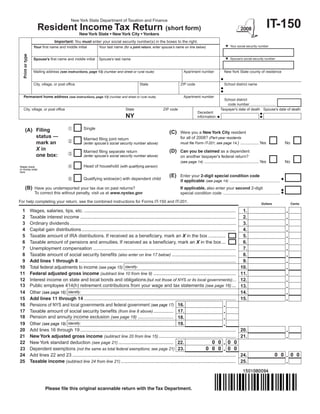

It 150 Resident Income Tax Return Short Form And Instructions

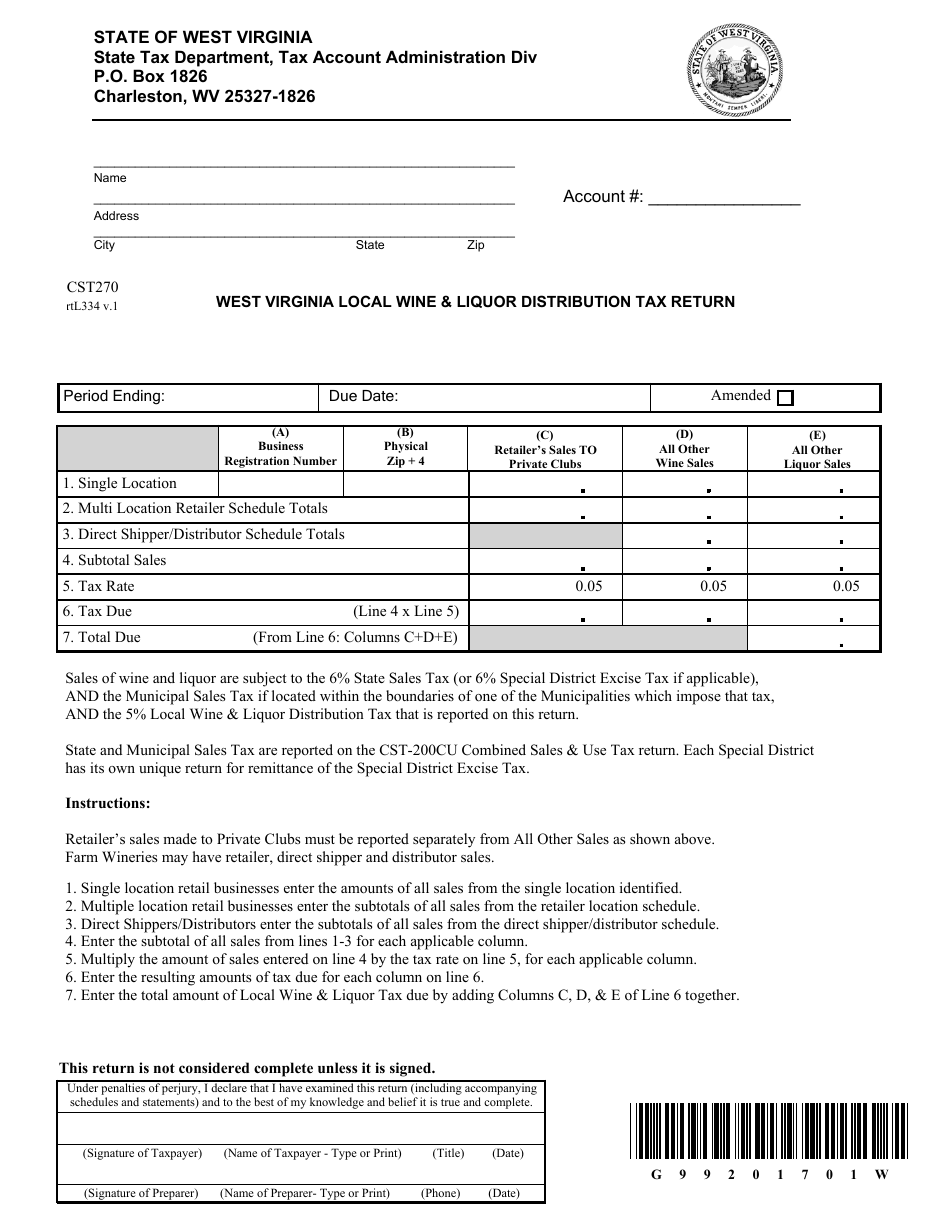

Form Cst 270 Download Printable Pdf Or Fill Online Local Wine Liquor Distribution Tax Return West Virginia Templateroller

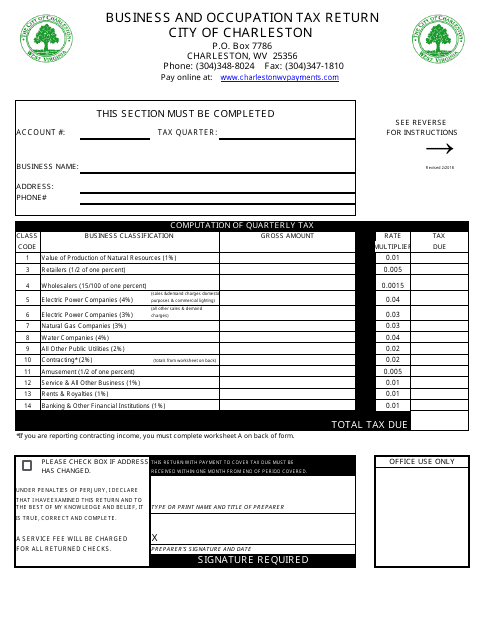

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

A Financial Calendar For 2020 21 Keep Your Date With Investments Taxes And Holidays Incometax Finance Calendar Investing Financial Financial Management

Wv Tax Deadline Extended To May 17 Wowk 13 News

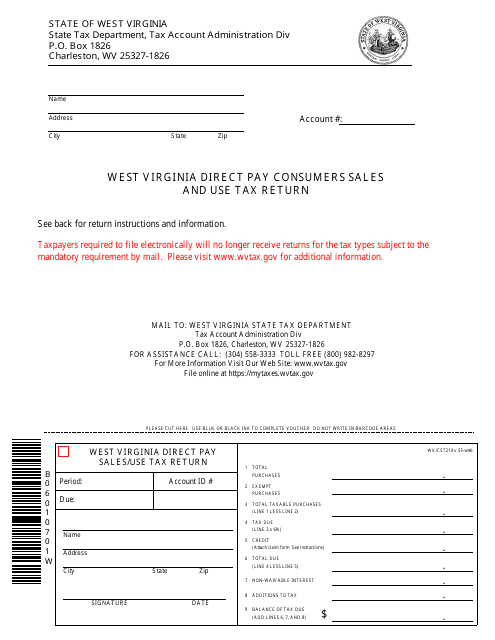

Form Wv Cst 210 Download Printable Pdf Or Fill Online West Virginia Direct Pay Consumers Sales And Use Tax Return West Virginia Templateroller

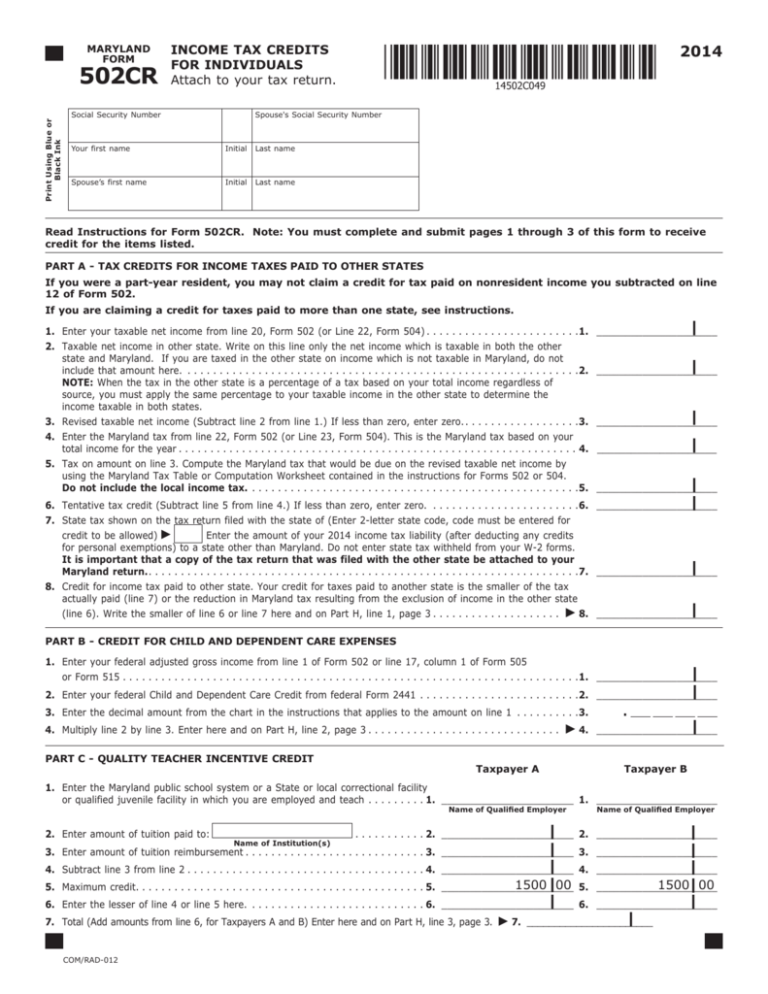

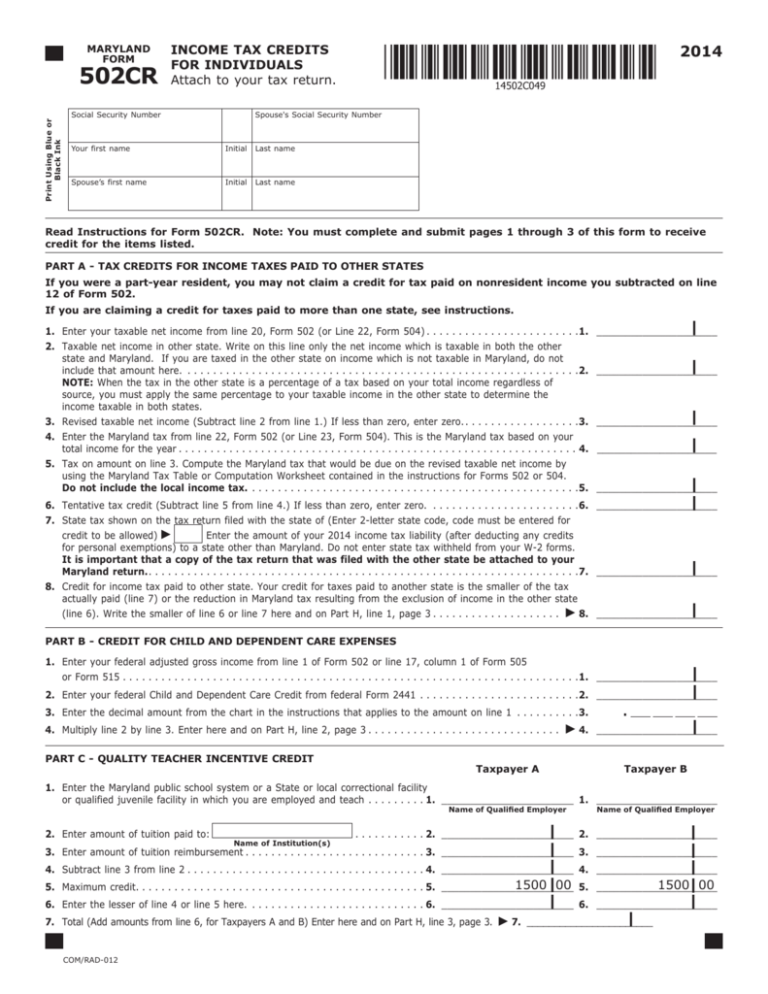

502cr Maryland Tax Forms And Instructions

Estate Taxes In Wv Filing A Final Estate Tax Return And Other Responsibilities Blog Jenkins Fenstermaker Pllc

West Virginia Tax Forms 2019 Printable State Wv It 140 Form And Wv It 140 Instructions Tax Forms West Virginia Tax

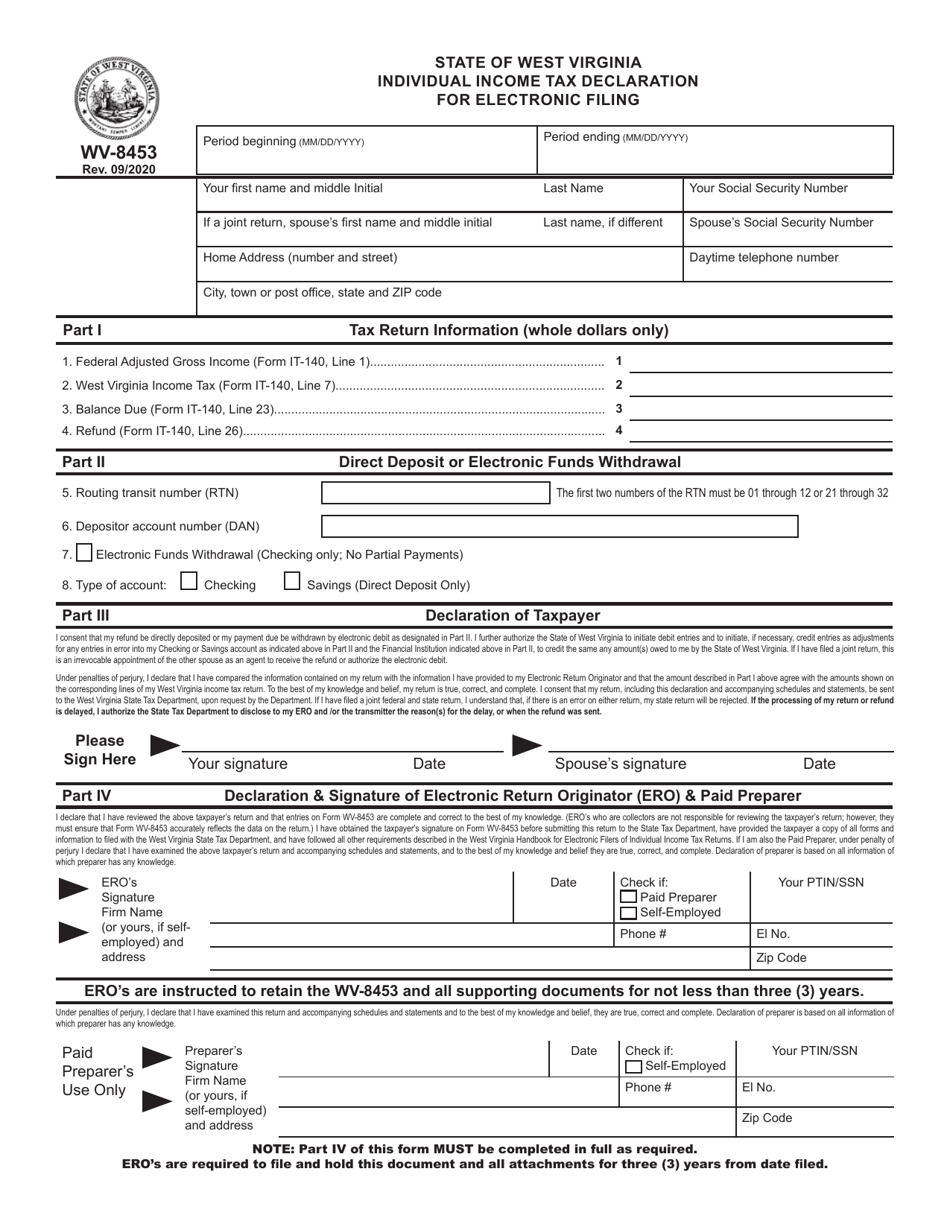

Form Wv 8453 Download Printable Pdf Or Fill Online Individual Income Tax Declaration For Electronic Filing West Virginia Templateroller